All the expenses that you incurred to run your business you are eligible to claim them: office expenses, supplies, salaries, bank charges, insurance, utilities, vehicle expenses, etc. Always providing copies of the receipts and proving that the expense is actually related to your business. If you are in the food business buying supplies like sugar and oil are totally fine, not the same with a software business that the amount of sugar is just related to supplies to giving coffee or tea to your clients when visiting your office. All expenses need to be justified and supported by the nature of the business and the proper supporting documents.

At CRA website you can find a long list of expenses you are able to claim: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/business-expenses.html, just be careful with which ones are actually necessary. Remember that the goal is not pay for all the expenses in the list but expend the necessary amount of money to run your business and still be able to pay yourself. I once met with a client that bought anything she can find for her business, her justification “it is eligible, it’s a business expense”. When I asker if she can actually afford all that expenses she was surprised that she could only pay “in cash” for just part of the expenses and the other part she didn’t actually need it. Her business now is running better, she is able to pay herself, have a profit to invest and find the cutest toy for her daycare business.

If you have a web design business you need top of the notch software, but if your business is a daycare you can do it, for starters, with a free version of FreshBooks. Sometimes is not the expense per ser, the main point is if we need it or if we can afford it. We totally understand we need to invest to sale, but are you aware of smarter ways of running your business?

- You can use free software - even accounting software - that help you be organized and run your business. Once you grow enough and are able to pay you can upgrade.

- Even if they are not free you can use technology on your favor: online payment services, teleconference services. Buy the software you really need.

- Don’t buy what you don’t need, even if is on sale.

- Plan, use budgets to track your expenses. If is not in your budget don’t buy it.

- Go paperless, print only what is necessary

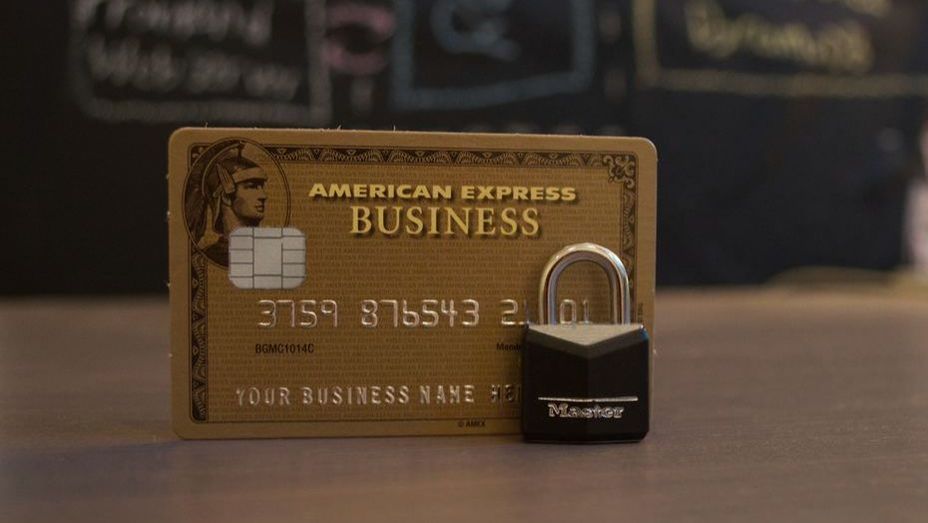

- Reduce your credit card debt, reduce your interest payments.

- Instead of renting an office, be creative. Use co-working spaces (if appropriate for your business model) or work from home.

In summary, we can always plan for ways to afford the business expenses and run a profitable business which can support our life style.

Photo by Ryan Born on Unsplash